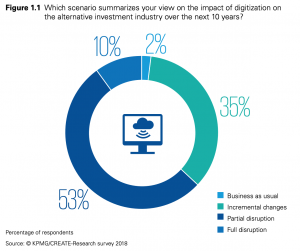

*(Based on experts from KPMGs report, “Alternative investment 3.0”, February 2018)

Digitization in asset management is growing faster than ever with the potential to penetrate every activity, from trivial activities up to investment decisions. Previous waves of information technology mostly automated routine manual processes to reduce costs and enhance accuracy. The current wave, on the other hand, seeks to deliver end-to-end solutions within more joined-up businesses via speed, connectivity, insights, transparency, personalization, and disintermediation.

“Digitization is about business transformation. That means it is as much about leadership as about technology. Such digital leadership, in turn, is about shedding the old mental baggage and re-anchoring the business into the new age. This is easier said than done, especially when technology advances at a speed that far exceeds humans’ ability to adapt. For late adopters, the gap between the two gets bigger and bigger over time with corporate inertia.”

How does the Fund Management industry adapt to these constant innovations? Are today’s Fund Managers just following the trends, or are they paving their own path?

Digital leaders’ to-do list:

- Craft a vision for the new age. In this age, digitization will be a way of life for all businesses.

- Set clear digital goals and their rationale, get the necessary emotional buy-in from the movers and shakers across the business while allocating responsibility and hold people accountable for outcomes.

- Ensure that the rationale not only highlights the business benefits but also shows staff how the vision will affect them and what’s in it for them.

- Develop a ‘stepping stone’ strategy with respect to technology. Generating early successes at each step, learning from setbacks and using that learning to move forward.

- Recognize that the genius in the vision is not only in design but also in execution. It’s about mixing the best of the old and the new.

- The strategy should have clear milestones and metrics that are capable of review. One key lesson from the success of the internet giants is that progress comes in fits and starts, not a linear progression.

- Finally, leaders must show restless dissatisfaction with the status quo, walk the talk, ask catalytic questions and challenge inertia. They must also network with their peers in other companies and industries to learn what has worked, what hasn’t and why.

Collaborate with FinTechs

- They are better, faster, leaner, cheaper and tailored: that’s how they are making headway in alternative investments. For example:

- Leveraging an artificial intelligence algorithm (Like BlueFireAI) that analyzes millions of data points and the voices on the internet structured and unstructured — to help generate alpha.

- Delivering sentiment data and early alerts with plug-and-play access to trading platforms

- Creating new platforms for long-short strategies, currency

- For alternative investment managers with inadequate in-house capabilities, FinTechs provide a viable alternative avenue. Unaffected by legacy issues, they bring fresh perspectives on long-standing issues, respond to challenges around them and deliver credible solutions

- Take advantage of smart CRM and Web portal systems. Today’s investors are much more data-driven and have come to demand a greater level of transparency and more frequent communication from their fund managers. Digitally savvy fund marketers are able to take advantage of this trend and deploy online technologies to scale their ability to target and communicate with investors.

Form strategic partnerships:

- Alternative investment firms have a long tradition of outsourcing non-core investment activities. Some of them are now tooling up to become providers of technology solutions too — as part of end-to-end service offerings.

- In this, they are assisted by the ‘virtualization’ of technology that converts physical IT assets into virtual ones through means such as cloud computing and ‘software-as-a-service’.

- This allows managers of all shapes and sizes to access institutional quality technology to compete with large players in their industry.

- Above all, it gives administrators a high degree of adaptability accompanied by cost-effectiveness.

- These integrated platforms are moving towards a ‘single view’ that enables managers to make faster smarter decisions with regard to portfolio management, research and order management, among others.

“Data is a minefield. We have to determine what is actually important from what is just noise.”

Improve the human-machine interface

Machine learning cannot as yet explain why it makes the trades it does. It is also not as accurate at predicting future events in areas where there are no rational patterns. If machines make mistakes and lose money, it is hard to explain to investors who want to know exactly why returns are below their benchmarks. On the other hand, humans are highly intuitive: good at time horizon, subtle nuances around the data and the deeper meanings behind macro events. But it’s impossible for them to keep up with all the research and events that have an impact on their returns.

Machine learning can play a powerful role in informing and influencing human judgment. But we have to find ways to make it more transparent to its designers and users.

Establishing the necessary trust will remain a matter of step-by-step improvements — as happened with mass air travel. It would be unwise to participate in a blanket rejection of machine learning because of its limitations at this stage. The key is to make pragmatic use of it where it is likely to have maximum impact. That means augmenting human intelligence with machine intelligence in ways that deepen rather than diminish it. Augmented intelligence — as it is now known — is about combining the best of both, as managers blend quants and fundamental investing to deliver the so-called ‘quantamentals’.

To, conclude, therefore, only savvy digital leadership will differentiate winners from losers, as competition goes from benign to malign.

Which side are you going to choose?

FundPortal from Edgefolio offers marketing tools, file sharing and analytics solutions for fund marketers and managers alike. If you would like to find out more or to see a demo, feel free to contact us.