ESTea #17 15/09/2021 The carbon price of bulls***

There’s only one thing worse than greenwashing – green bull****ing.

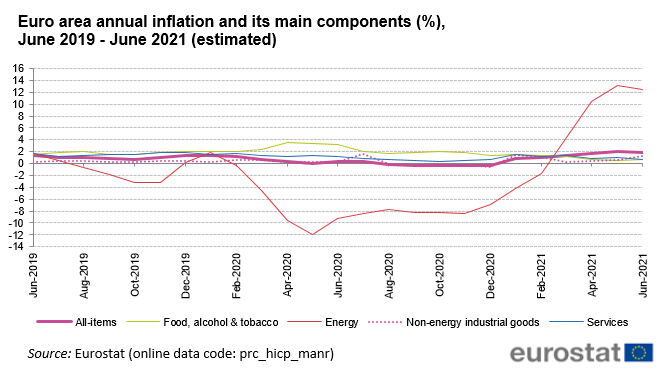

ESTea #11 12/07/21 Is ESG investing driving inflation?

It seems that 2021 will be dominated by two key themes: green investing and the fear of runaway inflation. The two themes may be linked, with a two-year surge in investment being partly to blame for the simultaneous increase in both prices and wages.

ESTea #9 28/06/21 Your investment portfolio is a carbon nightmare.

If you’re above 35 and live a developed country, almost certainly the worst thing you did for the environment last year was having money in carbon intensive retirement, ISA and investment funds.

ESTea #7 14/06/21 Cornwall Consensus or Carbis Delay?

This week’s newsletter is a close reading of the output from last week’s G7 meeting in Carbis Bay, Cornwall. These ‘Communiqués’ are traditional, formal but important statements published both by the organiser of an event (‘The G7’) and then republished or reiterated by the individual attendee nations.

ESTea #5 01/06/21 Wherein the author defends some ‘green’ hedge funds that invest in oil companies

It’s a tale as old as time. Monkey see band wagon, monkey get on the band wagon.

ESTea #4 24/05/21 ExxonMobil AGM Pressure

On May 26th (this Wednesday), Exxon’s AGM will bring to a head the last year of activity from proactive, environmentally-minded shareholders.

ESTea #3 17/05/21 Musk delivers the ESG tendies

This was the week were Bitcoin got its bad boy image back – partly because it puts out more carbon dioxide than a small country countries, but mainly because a billionaire playboy (come playadult) tweeted about the previous fact.

ESTea #2 10/05/21 Setting off from basecamp

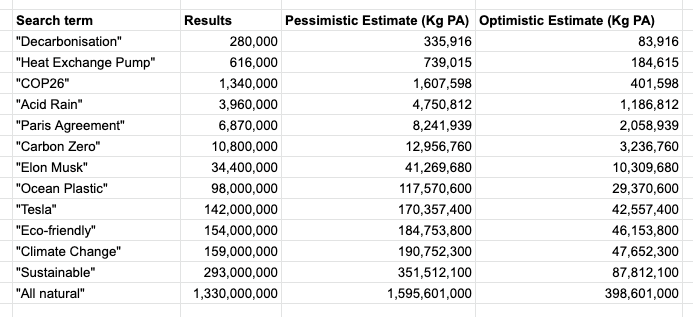

We’ve been doing some work here at Edgefolio to see what the world of ‘ESG’ funds really looks like. With our Fund Platform technology we’re in a unique position to be able to search through our database of 150,000+ funds, looking for fund names and descriptions with the most popular ‘ethical’ investing terms.

ESTea #1 04/05/21 An introduction to ESTea

As this is the inaugural ESTea newsletter, it’s going to be a short one. Let me start by explaining why we have this newsletter and blog, what we think it might become, and what you can expect.