Why does a hedge fund need a client portal?

Why does a hedge fund need a client portal in 2022? Transparency? Yep. Marketing? Absolutely. We delve into all the reasons why it is crucial in 2022.

Template: Prospecting email for fund managers

Emerging fund managers need to master the art of a great prospect email due to less contacts and experience – Edgefolio has tips.

Product update release: FundPortal, the hedge fund CRM

We have a clear vision of FundPortal’s role, sitting at the heart of our clients’ marketing and investor relations operation. With this latest major update, we are now the hedge fund CRM for our clients, providing the automation, tracking and visualisation that will underpin their growth strategies.

Why do hedge fund managers need an integrated CRM?

Why should hedge fund managers adopt a CRM? Edgefolio explores some of the principal reasons and benefits for asset managers below.

Edgefolio partners with BNP Paribas to launch ‘Bridge’ – Providing Digital Capital Introduction Services for Institutional Investors

‘Bridge by BNP Paribas’ to Provide Digital Capital Introduction Services for Institutional Investors. Partnership with Edgefolio strengthens the bank’s cap intro offering.

What does the SEC’s ruling mean for hedge fund managers?

The SEC has proposed a new set of regulations for hedge funds and hedge fund managers. The move targets greater transparency on performance, fees and much more.

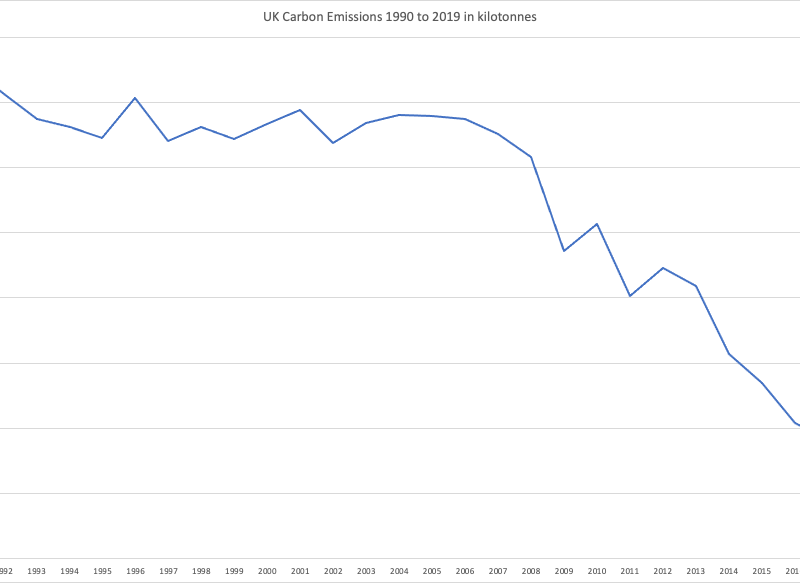

ESTea #21 11/11/21 UK emissions haven’t been offshored

Sarah Olney is not the only person criticising the UK government for ‘offshoring’ emissions from the period 1990 to 2020. Offshoring in this context means that either emissions that used to occur in the UK, now occur in other countries, or that new emissions have been created in other countries that properly should ‘belong’ to the UK.

ESTea #19 14/10/21 Spotlight on: Tikehau Impact Credit

The world of high yield credit has, so far, been relatively impregnable against the crashing waves of ESG investment. Not so from summer of this year, when the team at Tikehau launched their `Tikehau Impact Credit` fund*.

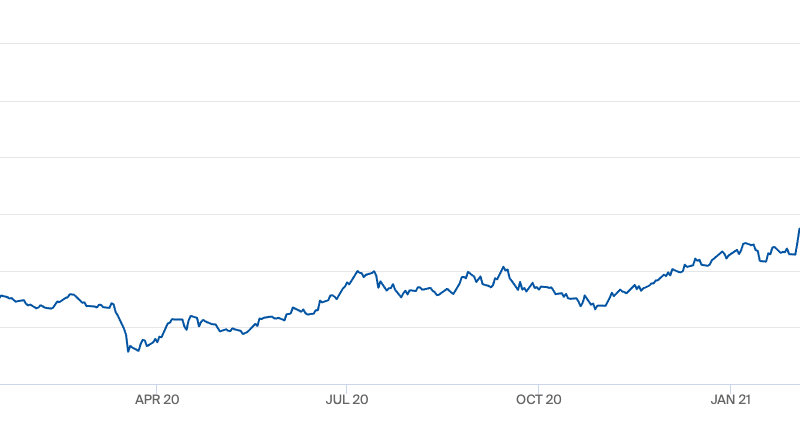

ESTea #18 22/09/21 Spotlight on: Altana Carbon Futures Opportunity and Carbon Credit Hedge Funds

In 2005, as the European Union tried to plot a market-lead but effective path to lower overall emissions, they launched the world’s first major carbon emissions trading scheme .