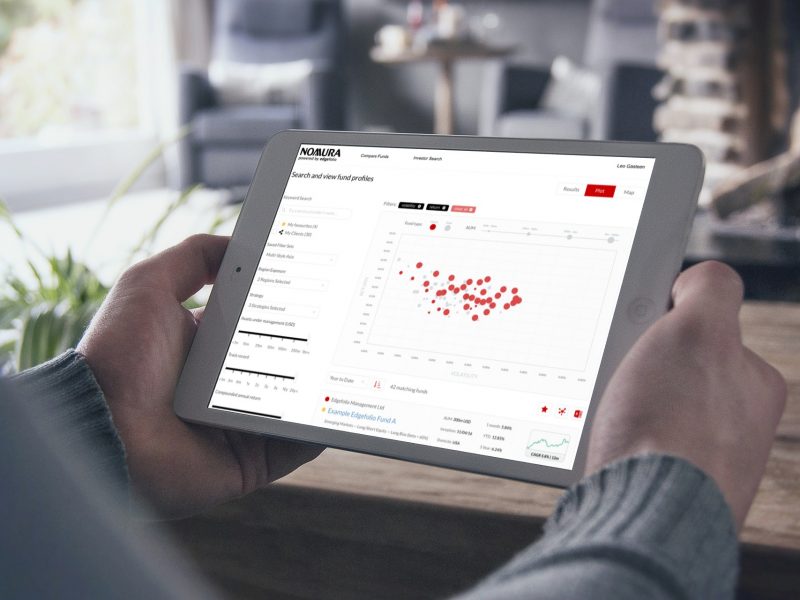

Edgefolio’s technology to power Nomura, Asia’s Global Investment Bank

Edgefolio is proud to have been selected as a technology provider to Nomura. This partnership marks the entry for Edgefolio into the Asian markets and brings Nomura’s Hedge Fund clients to the forefront of the industry’s movement towards greater transparency and stronger compliance – all in a powerful digital environment.

Hugo Fund Services using Edgefolio to enhance capital introductions

Hugo Fund Services, a Swiss representative specialised in alternative investment funds looking to market to qualified investors has announced its partnership with Edgefolio.

Edgefolio’s founder talks to Business Reporter on the future of asset management

“Asset management 2.0 will be characterised by AI (robo-advisers) and data-driven decision-making, necessitating the need for a centralised data-aggregating product where key stakeholders in the space can interact. At Edgefolio, this is exactly what we are building – a marketplace connecting allocators with fund managers in a compliant, secure and beautiful way.

Edgefolio awarded “Most Disruptive Technology Solution” at European Hedge Fund Technology Awards 2017

Edgefolio’s fund data management & analysis solution has been voted “Most Disruptive Technology Solution” by the European Hedge Fund Technology Awards 2017.

The ceremony, which took place on Tuesday 12th September at Plaisterers’ Hall in London, recognises technology providers across 30 different categories that serve the hedge fund sector and have demonstrated excellent customer service and innovative product development over the past 12 months.

Global Prime Partners announces joint venture with Edgefolio

Global Prime Partners enhances client offering through Edgefolio’s Cap Intro services

Global Prime Partners, a multi-award winning financial services firm that provides prime brokerage, execution, structured products, custody and clearing services to hedge funds, has today announced a joint venture with Edgefolio to provide Cap Intro services to its prime brokerage clients.

Top Goldman banker, Marc Gilly, joins Edgefolio’s Advisory Panel

Marc Gilly, one of Goldman Sachs’ top hedge fund bankers in Europe, has left the company, sources told Reuters.

In his role as head of client-facing activities for European Prime Brokerage and global co-head of capital introductions, Gilly helped hedge funds with a range of services including sales and introductions to potential investors, product development and technology.

Edgefolio announced partnership with FinLab Solutions SA

Edgefolio is delighted to be partnering with FinLab Solutions SA, a software solution company, focused on providing workflow & data management tools to institutional investors.

As part of the partnership, FinLab Solutions SA has integrated Edgefolio’s data into its investor product-offering, thereby providing its clients with a larger underlying universe of funds.

Edgefolio Wins Venturespring Future of Finance Challenge 2017

Venturespring, the international venture development studio, in association with IBM, NatWest, Level39, and Tech.London was pleased to announce hedge fund platform, Edgefolio, as the winner of The Future of Finance Challenge.

Edgefolio’s platform connects investors and hedge funds, creating technology-driven solutions for a traditionally conservative and fragmented industry.

Participants were given seven minutes to pitch their concept, the companies were then judged by an expert panel from the venture capital and the finance industry including participants from IBM, NatWest, Level 39, Innovate UK, Transferwise, Octopus Investments, Angles Den, and more.

Edgefolio showcases technology at DIT’s Fintech Trade Mission to Tokyo

The UK’s Department for International Trade hosted its second ‘Fintech Trade Mission’ to Tokyo, Japan between the 16th to the 20th of January 2017. Edgefolio was one of 14 UK companies selected for the trip, which aims to help UK firms showcase their products & services to the Japanese market.