ESTea #2 10/05/21

We’ve been doing some work here at Edgefolio to see what the world of ‘ESG’ funds really looks like. With our Fund Platform technology we’re in a unique position to be able to search through our database of 150,000+ funds, looking for fund names and descriptions with the most popular ‘ethical’ investing terms.

Mapping the universe

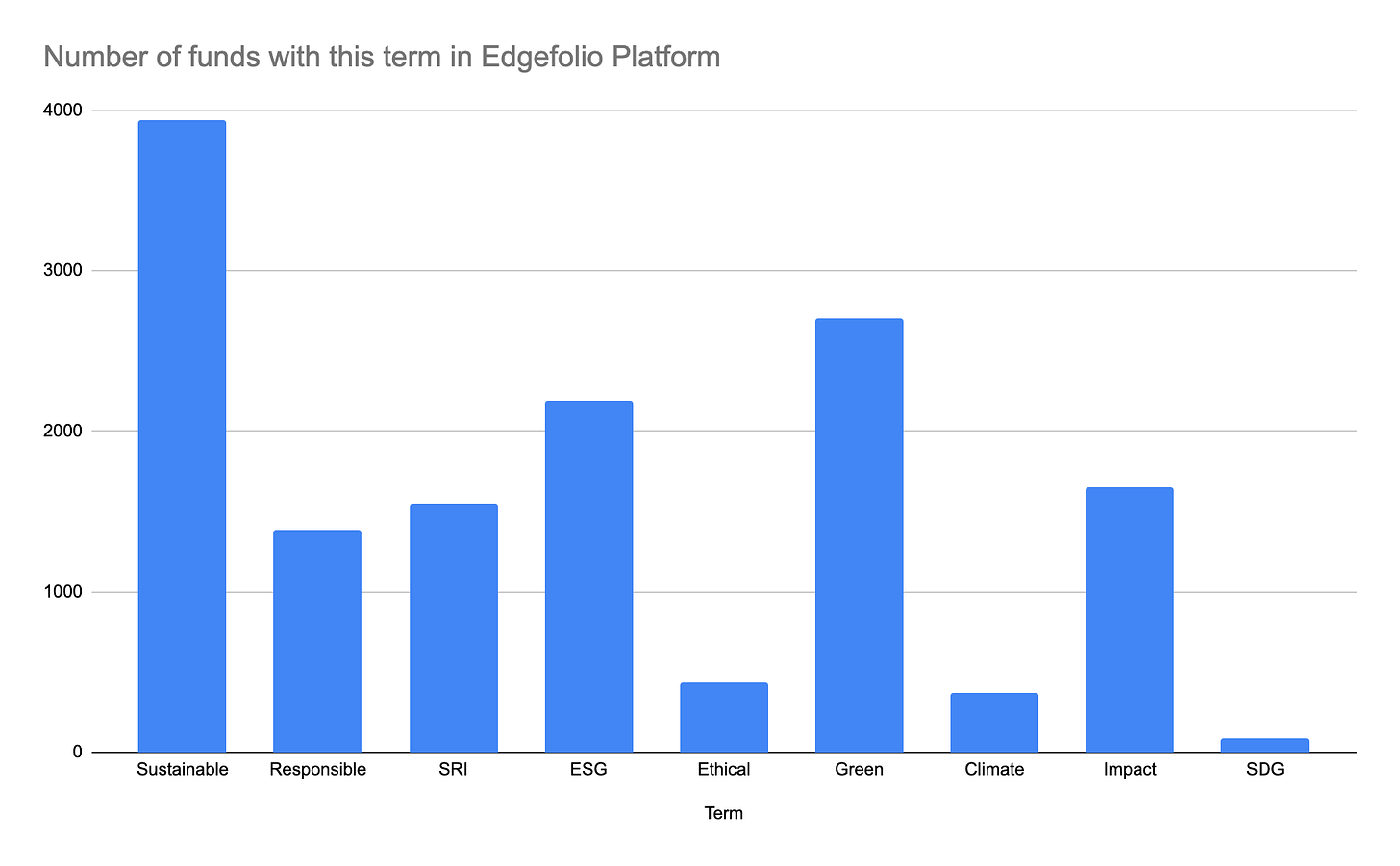

We’ve been doing some work here at Edgefolio to see what the world of ‘ESG’ funds really looks like. With our Fund Platform technology we’re in a unique position to be able to search through our database of 150,000+ funds, looking for fund names and descriptions with the most popular ‘ethical’ investing terms.

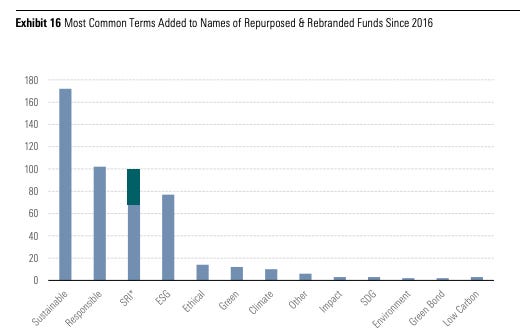

We got the search terms from Morningstar’s research on the most common re-naming conventions for ESG funds.

Then, when we ran the same terms through our platform and found some quite different patterns.

The Morningstar data relates specifically to a) the name of the fund and b) only funds that have been renamed. On the other hand, our data takes in all funds and accounts for where a fund uses the term in their fund description or name.

The key takeaways are

- ‘Sustainable’ is still the most widely used term. I think is most likely because ‘sustainable’ is, by far, the most flexible term in the dataset. Obviously it can relate to something being environmentally sustainable but it really only means that a particular business model can be ongoing – which most business models can.

- ‘Green’ over-performs in our dataset. This is most likely because it’s a generic, reusable term that can be used in the description of many different funds. Perhaps indicated that Fund Managers are keen to put it in the description but not the name…

- ‘Responsible’ underperforms in our dataset (compared to Morningstar). This one is a puzzle so please leave a comment about why you think it might be.

This week

Upcoming events

News

- Global media coverage of ESG investment has exploded

- European Central Bank Appoints Irene Heemskerk to Lead Climate Center

- Growing Influence of ESG Increasingly Evident in Market Prices