ESTea #15 18/09/21

Since 2017 – long before many of us even heard the phrase ‘ESG’ – Colm O’Conner at KBI has been building the Global Sustainable Infrastructure Fund (GSIF). Now in its fourth year, the fund has great performance, runs under an Article 8 banner and invests in all the companies I wanted to work for when I was a kid…

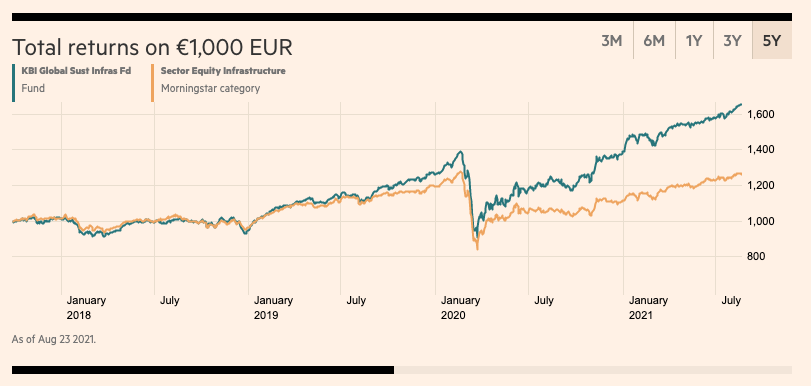

And it completely destroyed the benchmark last year.

The fund’s stated investment goal is as follows:

The Fund will invest primarily in shares of companies … which generate a substantial portion of their turnover from the provision of sustainable infrastructure facilities and services. Such companies are primarily involved in the supply or treatment of water, waste water and energy, or in the provision, maintenance or enhancement of energy infrastructure, water infrastructure or infrastructure designed to support the production and efficient distribution of food and crops.

and this is reflected in their current top holding:

- National Grid PLC (6.2%)

- Greencoat Renewables PLC (4.6%)

- Nextera Energy Inc (4.5%)

- E.ON SE (4.1%)

- Hydro One Ltd (3.85%)

The fund has great geographic distribution with around 1/3 invested in the Americas, 1/3 in Greater Europe and 1/3 elsewhere. Although there is some sectorial distribution, at least half the value is in electricity utility companies.

A handful of renewable generators like Nextera, who have climbed 20% in the last year, have contributed to KBI’s performance – and a worsening outlook for traditional electricity utilities has only amplified GSIF’s performance versus the non-ESG benchmark.

GSIF’s environmental credentials were never really in doubt – considering their strategy and methodology. It’s generally hard to mess up the environment through investing in Solar Power Plants and Wind Turbines (although I’m sure someone can think of a way).

On top of this strategy, the entire KBI outfit have their proprietary methods and metrics for keeping track of their fund impact – in particular they try to tie in to the UN’s Sustainable Development Goals (SDGs). You could say that this is simply a convenient way to outsource difficult ethical trade-offs, but these funds are fundamentally not stacked full of ethical philosophers (I assume) and it’s useful to have established guidelines.

It’s notable that none of the team I could find have a background in calculating environmental impact – instead the team comes from a reasonable traditional investment and economics background. While this isn’t surprising, in future I think we will see more and more specialists in this space.

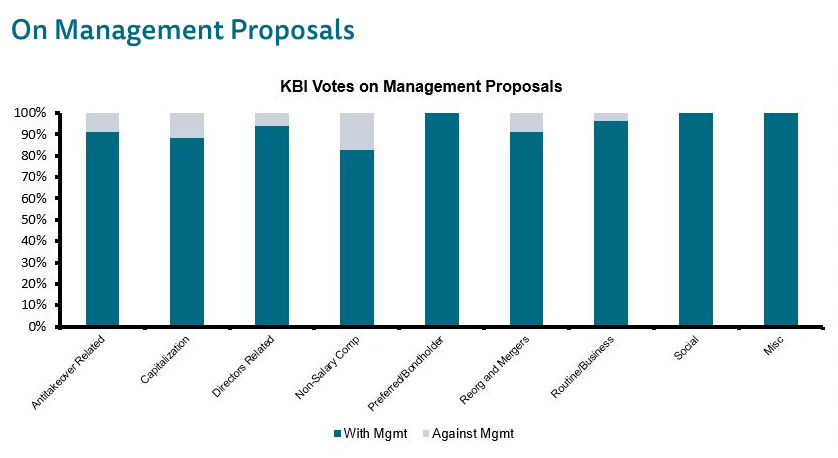

KBI’s proxy voting does generally go along with management proposal which, again, is not unusual, but is a small signal that they are less likely to be standing up to management in general. What’s great news is that they’ve employed the service of Institutional Shareholder Services ltd to put together proxy voting guidelines which, in theory, fit with a sustainable approach. However, without seeing the specific of the policy – it’s impossible to fully access it.

All in all, this is a great fund with amazing performance and invests in just the coolest companies. One portfolio company, Iberdrola are building the largest photovoltaic plant in Europe covering 1000 hectares. I’m just jealous of all the cool trips to sustainable infrastructure…