Today’s investors increasingly conduct extensive online research before making allocation decisions.

Emerging and established hedge funds are leveraging content marketing not just as a ‘nice-to-have’, but as a key differentiator that demonstrates their expertise in the field and builds brand trust.

Whether on a small or large scale, all hedge funds should be producing content to show the world who they are, and what they stand for as a firm. An ample content strategy is key to creating meaningful relationships with potential investors.

Online, investors are seeking deeper insights into:

- Your investment philosophy and decision-making process

- How you navigate market volatility and manage risk

- Your team’s expertise

Three pillars of fund content

Pillar 1: Thought leadership content

Showcase your expertise through:

- Market analysis pieces that showcase your unique perspective on sector trends and emerging opportunities

- Interpretations that elevate wider conversations on the industry

- Economic commentary that provides context for your firm’s investment decisions

Pillar 2: Educational content

Build trust through:

- Deep-dives about adapting to changing regulatory/compliance landscapes

- Case studies (where compliance allows) showcasing real-world application of your strategy

- “How we think about…” series

Pillar 3: Relationship content

Strengthen investor connections through:

- Behind-the-scenes content introducing team members and company culture

- Event recaps from conferences and meetings

- Interactive content like webinars and Q&A sessions

Content formats examples

LinkedIn commentary

- Build personal brands for key investment team members

- Share your takes on current market insights and reactions

White papers and research reports

- Generate qualified leads through gated content

- Establish authority in your investment specialty

Webinar series

- Leverage the expertise of your leadership team or founders

- Enable real-time interaction with prospects

Podcast participation/hosting

- Forge authentic connections through long-form conversations

- Cross-pollinate audiences with other industry experts

Keeping it confidential

As much as managers should be putting out more content, it’s important to keep in mind the regulator as well as your competitors. Having great content is a fantastic way to build an audience, so it’s important to consider how you’re going to distribute it securely. One such example is your client portal, which can act as a hub to engage your investors at scale..

Below are a few simple ways you can feature your content within Edgefolio for Managers, our all-in-one portal for fund managers.

Showcase your white papers, reports, and decks in your Data room, adjusting permissioning where necessary

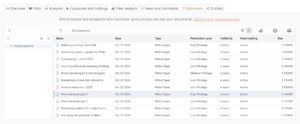

Feature images, blogs, podcasts, videos, and more in your News and comments tab

Feature your fund’s pitch and images within the Pitch tab

Conclusion

Instead of telling your investors how trustworthy or insightful your firm is, good content marketing employs a ‘show, don’t tell’ approach. Content marketing for hedge funds is not limited to creating viral social posts, but demonstrating your expertise and building trust.

If you’d like to learn more about our Edgefolio for Managers solution and how it can elevate your content strategy, get in touch with us.