ESTea #18 22/09/21

In 2005, as the European Union tried to plot a market-lead but effective path to lower overall emissions, they launched the world’s first major carbon emissions trading scheme .

The idea was simple – nations are assigned the right to emit carbon (carbon credits) inline with their national commitments under the Kyoto Protocol and then nations auction or assign these credits to companies and organisations. The number of credits represent their total allowable amount of emissions over that period (around 7 years).

Where an organisation needs more credits they can buy them on a European market, and where they need fewer they can auction them to other European companies who have been found lacking. Emitting without the necessary credits leads to substantial and well-enforced fines.

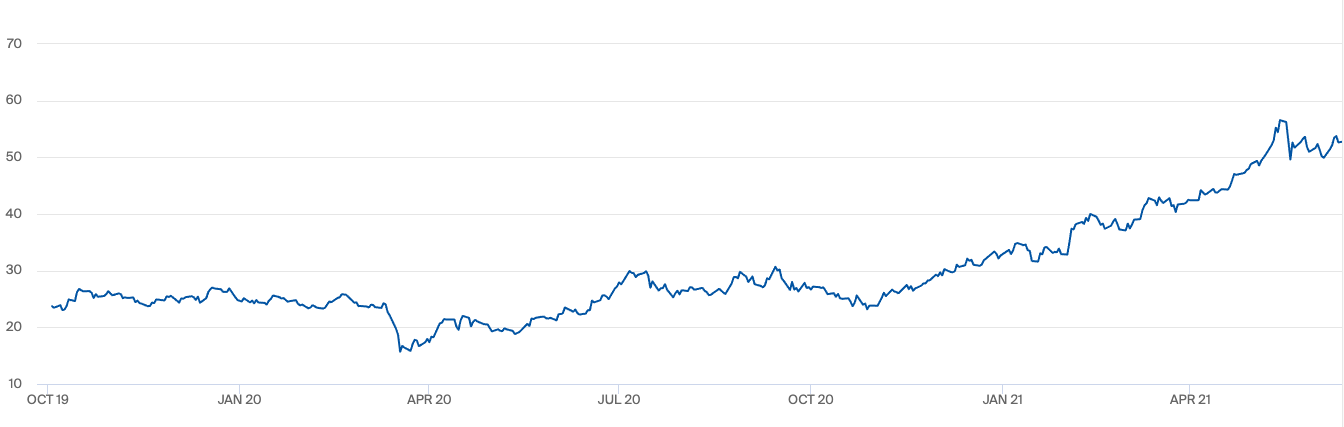

I can tell that you in the early days there were simply too many permits allocated, free of charge, for the secondary markets to operate properly. However, from the start of ‘Phase 3’ (i.e. 2013) the number so permits has tightened, maturing the market and driving up the price of credits. Which, of course, is exactly the point.

‘Phase 4’ (i.e. 2021 onwards) will only constrain supply further with reduced caps and more credits auctioned rather than allocated. Altana’s Carbon Futures Opportunity Fund (ACFO) is one of an emerging band of hedge funds looking to capitalise on this new marketplace (and quickly being quite successful).

In some ways, Carbon Credits are the perfect market for Hedge Funds to operate in.

For example, there is an institutional commitment from the virtually every EU body and government to systematically increase the prices paid for Carbon Credits over the ‘Phase 4 period’. Various methods have implemented in legislation to ensure that credit prices creep surely high squeezing industry to emit less.

Not only this, but unlike in a traditional equities market, both sides of a carbon credit trade could be consider ‘sustainable’ meaning that it would be easy for a funds like ACFO to go for an Article 9 classification under SFDR and therefor attract more European institutional capital over the next decade.

Altana’s ACFO itself hasn’t yet decided on it’s SFDR classification but for an ethical institutional investor it’s worth noting that in a traditional market, going long on a carbon intensive company involves funding emissions and going short on an ethical company can equally be considered to be ‘funding emissions’. Many types of potential trades may easily be considered to have a substantial carbon footprint.

On the other hand, buying carbon credits is raising the price of carbon in Europe (a net good for the environment), selling carbon credits is assigning them to the person who most needs them most, and holding onto the credits means those emissions can’t occur in the present and must therefor be deferred. Any financial action taken regarding carbon credits is at least carbon neutral, if not better.

In a market predicated entirely on the regulatory demands of the European super-state there is clearly substantial downside risk of a regulatory change of heart. This risk should be considered very low given treaty commitments, organisational stability, and a global consensus however, there are ways the EU could catastrophically destabilise the marketplace, either deliberately or by mistake. Far more than a traditional global ‘free’ market.

Altana has positioned itself well to be able to manage this risk, telling us in a request for comment:

Add to the very strong fundamental market dynamics, our edge in managing tail risk (to protect against a sudden change to the scheme by the EU), where we protect against the fat tails without a drag on the upside performance and the opportunity becomes even more exciting

Naturally they don’t give details on how exactly this is done, which is fair enough, but it’s reassuring to see that they’ve given serious thought and consideration to this challenge.

While ACFO was only founded in July and had a disappointing first month, their second month (Aug 2021) returned a staggering 25.20% net of fees. Clearly one month’s returns is no indication of what is to come, but certainly there are gold in them credits.

There are a small number of teams and funds like ACFO around the world looking at carbon credits as somewhat of a ‘one one bet’. A long running joke about Federal Reserve Policy under President Trump was that “stonks only go up” – now this is, in fact, true when it comes to EU carbon instruments – “Credits only go up”. This is European Commission policy, not simply automated reddit bot accounts.

As Altana rightly points out, carbon credits are a useful hedge for those investing in European heavy industry. With oil and electricity prices relatively stable and low, and carbon credit price steadily increasing – those credits will soon become one of the major cost centres for European industrial equities. Worst still, price surges in the carbon credits could easily halt a company’s ability to economically meet any increase in demand.

Altana Carbon Futures Opportunity, along with a small number of other European Carbon Credit trading funds are entering into a potentially very lucrative market with substantial upside both for investors and for the climate.

Whilst it may pain some to see wealthy investors benefitting from climate change, trading carbon credits is one of the most effective ways for investors to make good returns whilst also contributing to effective decarbonisation.

Postscript

If you have any doubt that these carbon credits are valuable and going up in value then I’d like to point you to a story form 2011 where ‘hackers’ stole 30 million euros with of carbon credits in Prague. In fact, 7 million euros of that amount was stolen directly from the Czech Registry for Emissions Trading itself!

If you’re ever in a pub, and someone approaches you trying to sell you the right to emit 1 tonne of carbon into European airspace for only 10 euros, please remember that those could be stolen Czech carbon credits.