The rebound in equity markets extended into May. The impact of the COVID-19 pandemic continued to dominate markets, with an increasing focus on how countries would begin to relax their lockdown measures and how this would affect the economy. Volatility declined and the more moderate market moves compared to April suggest that investors are being watchful of how the situation develops.

Many states in the US began some level of reopening, though the daily infection rate has only fallen to around 65% of the peak infection rate from mid-April. The S&P 500 climbed to end the month 4.8% higher and is now just 10% below the February peak. The infection rate across the major European economies has fallen significantly, though the infection rate in the UK still remains high relative to its European peers.

Investors appeared to become somewhat more optimistic about the outlook after initial signs of success in human trials of a vaccine against COVID-19. Growth stocks outperformed value stocks while global government bond markets were broadly flat. European and Japanese stock markets, typically cyclical markets, also ended the month higher. Despite the first steps being taken to exit lockdown and some positive news on a potential vaccine, it’s still too early to say with confidence how the public health outlook will evolve.

(source: JP Morgan)

Edgefolio gathered the top funds from a range of fund types, you can find them below.

Long Only Funds

| Rank | Company | Fund Name | May ’20 | YTD | CAGR | 3 Years | AUM (Million $) |

|---|

(Criteria used: Track Record > 1 Year, Currency: $US dollar, AUM > $100m)

ETFs

| Rank | Company | Fund Name | May ’20 | YTD | CAGR | 3 Years | AUM (Million $) |

|---|

(Criteria used: Track Record > 1 Year, Currency: $US dollar, AUM > $100m)

UCITS Funds

| Rank | Company | Fund Name | May ’20 | YTD | CAGR | 3 Years | AUM (Million $) |

|---|

(Criteria used: Track Record > 1 Year, Currency: $US dollar, AUM > $100m)

Fund of Funds

| Rank | Company | Fund Name | May ’20 | YTD | CAGR | 3 Years | AUM (Million $) |

|---|

(Criteria used: Track Record > 1 Year, Currency: $US dollar, AUM > $100m)

Investors have found some cause for optimism as global containment measures have seen infection rates come down in many countries. The focus over the last month has shifted towards how successful countries will be with their lockdown exit strategies. There are tentative signs that countries are seeing increased activity, but countries which have been successful in preventing a second wave of infections have so far been opening very gradually.

Economic activity over the past month suggests that the second quarter will be worse than the first but investors are looking ahead to a possible recovery. However, significant uncertainty remains over when economies can fully and sustainably reopen and how quickly they will rebound. The longer infection rates remain high and social distancing is required, the more likely there will be more lasting impacts on the economy. Central banks and governments have so far helped cushion the blow to the global economy and markets but success will be measured by the extent to which companies avoid solvency problems and workers return to employment. Given the inherent uncertainty, investors might want to remain neutral on the outlook. We favour an ‘up in quality’ approach both within fixed income and equities with a focus on companies with strong balance sheets that would benefit from an improvement in the outlook but could also survive if the health outlook deteriorates. (source: JP Morgan)

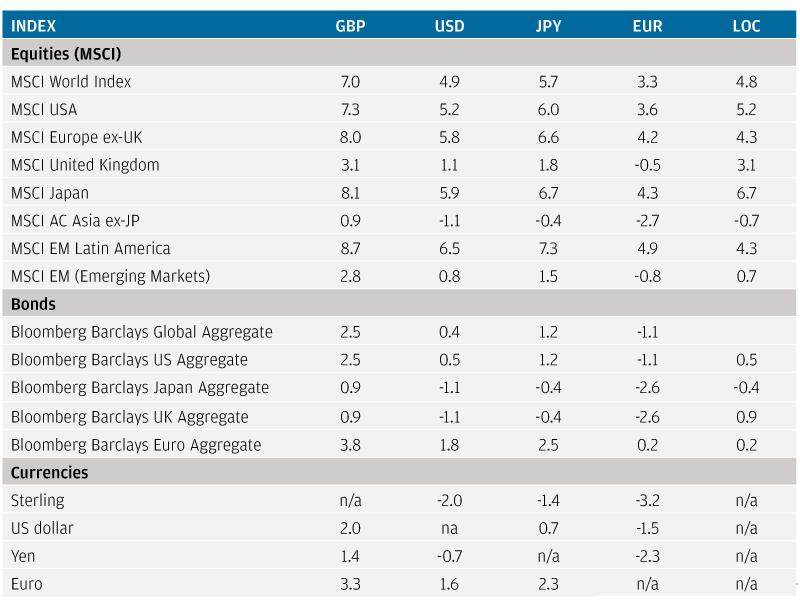

See below the Index returns for May 2020 (%).

Would you like to run your own analysis and view over 150k indepth Fund Profiles?

Stay safe,

The Edgefolio team

Access the in-depth analysis to view additional measures for this fund group, including relative measures, historical absolute returns, risk and reward analysis and more. You can analyse each of the funds in this group and customise your own fund comparisons on Edgefolio.com. To find out more, contact us for a demo. Sign up to our newsletter for further updates like this from our blog.

Disclaimer

Data provided by Morningstar. Care has been taken to ensure that the information is correct, but Edgefolio neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.