ESTea #5 01/06/21

When is a green-washed fund, not a green-washed fund?

It’s a tale as old as time. Monkey see band wagon, monkey get on the band wagon.

It’s a happy coincidence that the only band wagon in town right now (ESG) is also absolutely essential. If you take a look at the launches of new ‘sustainable’ branded funds – almost a third of them are existing funds which have been repurposed and rebranded.

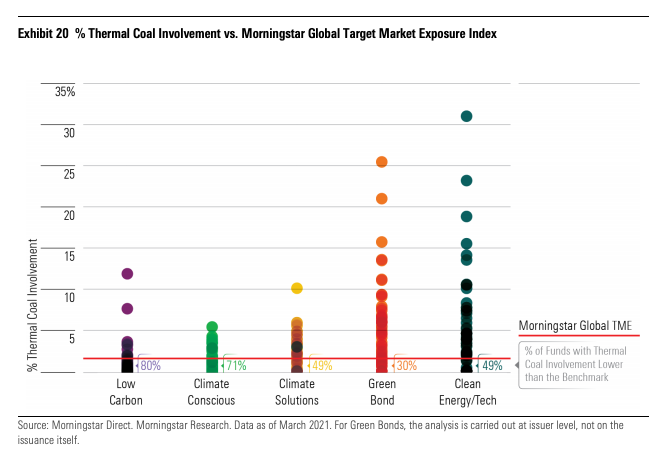

And, many of these funds look a little less-than-green when it comes to their portfolios. Take thermal coal for example. Half of all ‘Climate Solutions’ funds have a greater involvement in thermal coal than the non-ESG benchmark. Some have treble or quadruple the benchmark.

How can a ‘Clean Energy’ fund have 30% involvement in thermal coal? ‘This is greenwashing’ I hear you cry.

While there is no doubt that greenwashing occurs in the industry, and that Edgefolio/NewLeaf see itself as part of the solution, there is more going on here. The majority of ESG investors have invested substantial time and money into doing it the right way, and they have strict governance processes. Most of the ESG money is not ‘dumb’ money so funds are unlikely to think they can simply trick investors into investing into their fund. So what explains all these ‘green’ funds heavily involved in fossil fuels?

In Morningstar’s helpful graph, they break out funds into different buckets from ‘low carbon’ to ‘clean energy’ – each of these types of ESG funds are actually extremely different and represent different ideas about what a green fund should be doing.

While a ‘low carbon’ fund that invests in coal is green washing, a ‘climate solutions’ fund is not. That’s because a climate solutions fund sets out to pursue decarbonisation by lowering the amount of carbon produced each year. A ‘low carbon’ fund simply looks for the lowest carbon footprint per dollar invested.

If a ‘climate solutions’ fund invests into Disney or Netflix or Amazon, they are not investing in transition companies, instead they are invested in transitioned companies. Some of the ‘climate solutions’ funds which may, at first, look like they’re green-washing, are actually carefully picking the coal-involved companies which are transitioning away from coal and are therefore contribution much to the world’s decarbonisation efforts.

All of this speaks to one of the complexities about ESG. The industry isn’t have a philosophical or ethical conversation about what the ‘right’ thing to do is with respect to sustainability.

Instead, different investors are coming in with their own ethics and they can pick from a buffet of funds to fit those needs.

For the analysts, consultants and decisions makers involved in this process it’s time consuming, complex and opaque. Morningstar and others have made an effort to do general classification of mainstream funds, but it’s not going nearly far enough right now.

In the coming months, NewLeaf is filling this gap. Allowing professionals to invest in high-performing funds that fit their specific-ethical needs around ESG.

This week

Events

News

- Defeats for Big Oil mark ‘sea change’ in climate battle

- Credit Suisse Raises Over $300 Million for Climate Solutions-Focused Venture Fund

- DFMs double down on ESG integration as client interest grows over past year