ESTea #8 21/06/21

This story went around almost all the major news outlets over last week. The story goes that, due to the reputation damage from Cristiano Ronaldo’s moving of a Coca-Cola bottle, the Coca-Cola brand was so damaged that they ‘lost $4bn of value’. The Guardian, The Telegraph and The BBC all credulously reported this claim over the second half of last week, with outlets like The Financial Times wisely steering clear.

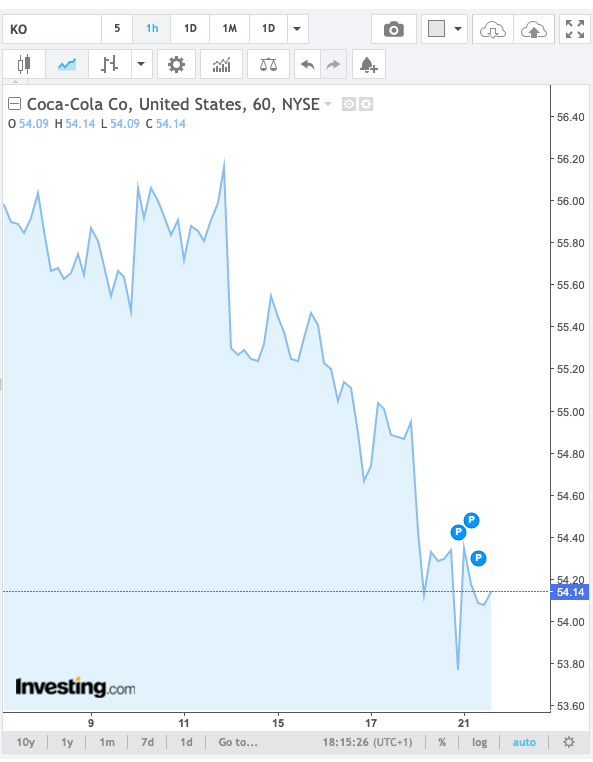

The idea that a footballer’s behaviour at a press conference can affect a sponsor’s stock price feeds into a real trend of lifestyle companies worrying deeply about their brands’ ESG credentials. There is a real risk that sustained ESG-criticism will affect equity prices through sales or brand degradation. And, there was a substantial downwards shift in the CocaCola stock price at roughly the same time as the press conference where Ronaldo moved the drinks bottles. It sort of feels true.

But, it isn’t true.

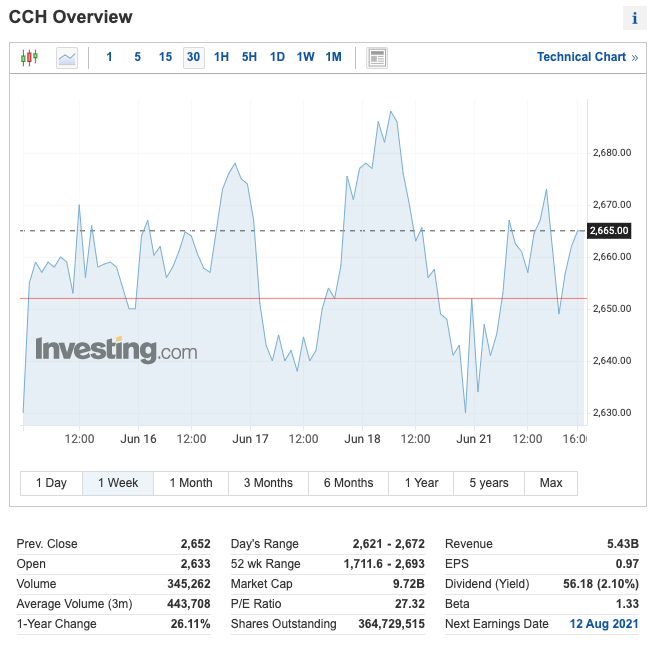

For starters, the timing doesn’t even really work. The press conference was at 9am UK time, and the US market aren’t open at this point. But the UK market for Coca-Cola European Partners PLC is trading in London and does just fine. As does the other European bottling operation: Coca Cola HBC AG (CCH). If anything, any reputation harm would have been felt hardest by the European bottling operations where football is more popular, not by the American parent company.

Yet, on the morning (US time) of the 15th the Coca-Cola price slips and ‘wipes off $4bn in value’ during that morning. Although, if you look at the chart below, it’s obvious that this decrease is the continuation of a trend from earlier in the week.

Pogba and Heineken

As if you needed any more proof, the next day Paul Pogba moved bottles of Heineken non-alcoholic beer completely out of view during an identical Euro 2021 press conference. You don’t need me to tell you that the Heineken stock price was just fine that day.

Why is this relevant to ESG?

One of the major pressures causing better corporate responsibility, especially for consumer-facing business, has been the threat of brand damage from bad ESG stories. This is obvious from the persistent green-washing in consumer brands and quick reactions of so many companies to breaking stories of sweatshop labour or deforestation.

Done right, the threat of brand damage from poor corporate behaviour is an important stick against major companies. It clearly factors into the investment decisions of hedge funds and asset allocators – you only have to look at the rise of data providers like RepRisk who rank and quantify the reputation risk that any particular equity offers.

But, a footballer moving a Coca-Cola bottle and replacing it with a water bottle (also made by Coca-Cola) is not a serious threat to that brand. ESG investors are wise enough to stay away from these frivolous media stories.

News

- Most ESG funds outperformed S&P 500 in early 2021 as studies debate why

- Shedding some light on the murky world of ESG metrics

- UK and Norway complete world’s longest subsea electricity cable

Now this

Old Cristiano Ronaldo CocaCola advert from 2000