Let’s breakdown the cost-base for the fundraising arm of a fund, which consists of 1 senior fund marketer:

Tangible Costs

- Senior Salary + Oncost: £100k p.a *1.4 = £140k p.a

- Overheads (office rent, technology, etc) = £30k

- Travel Expenses per annum (assuming 4 conferences p.a) = £60k

Total Costs: £230 k p.a

Let’s make a simple (but fair) assumption that the job will consist of

- 20% lead generation: cold-calling and cold-emailing prospective investors

- 20% Putting material together: factsheets presentations & DDQs

- 20% IR function: Handling ad-hoc investor / prospect requests for documents

- 20% Sales: spent on actual calls and meeting with ‘qualified’ investors / building pipeline

- 20% spent on thoughtful follow ups / pushing deals to the next stage & updating CRM

Hidden Cost 1: Expensive Admin Tasks

The opportunity Cost of doing non-sales related tasks, inevitably impacts the time it takes to achieve a set goal: say of raising $10m in the next 12 weeks.

In the above example, £92k is spent on non-sales related tasks every year, whilst £46k is allocated to lead generation.

#Yikes

Both of these areas can be remedied with the use of technology. For example, there are around half a dozen or so on-line marketplaces that help automate lead generation for fund managers, and there are some great technologies that automate the generation of factsheets, presentations and so on. Shoot me a note if you would like to know some names.

Hidden Cost 2: Factsheet Distribution is risky business

In part 1 we went over just how risky sending factsheets really is in the era of GDPR, andpart 2 outlined the lacklustre engagement and enthusiasm investors have towards receiving 100s of flat file pdf in their inbox every month, that they did not give their explicit consent towards receiving.

It’s an ineffective habit with a downside of EUR 20m. Just stop it already.

Hidden Cost 3: Opportunity Cost = Stunted Growth

Ok, this is a biggie. Let’s geek out a little to some Physics.

Escape Velocity is the minimum speed needed for an object to escape from the gravitational influence of a massive body. The escape velocity from Earth is about 11.186 km/s (6.951 mi/s; 40,270 km/h; 25,020 mph) at the surface.

In the case of Hedge Fund launches, our research spanning over 15,000 (both live and graveyard) funds since 1995 suggests that they too are subject to an escape velocity. Here’s the threshold:

If you don’t reach $115m within your first 3 years in AUM, the data suggests that there is an 89% chance you never will.

Conversely, 63% of the funds that reached $115 within the first 3 years of AUM enjoyed steady inflows and grew beyond $250m within the subsequent 2 years.

Time is of the essence when scaling a fund, so Fund Marketers should be looking at ways to expedite the sales cycle whilst reducing inefficiencies.

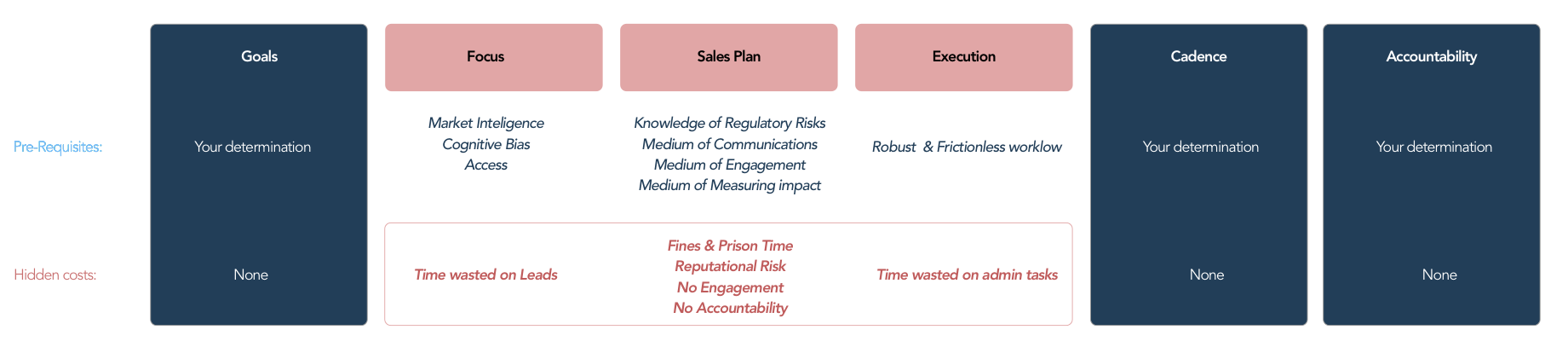

Below is a quick cheat sheet on the 5 stages of a sales and marketing plane, their pre-requisites, and where the hidden costs come into play

Bringing it all back to the basics

In part 3 we looked at the 6 ingredients a sales professional needed to be set up for success in this business. Three of these ingredients (Goals, Cadence, and Accountability) depend entirely on your determination. The three others (Focus, Sales Plan, & Execution), require a bit more than your will power.

This is where it gets interesting.

In terms of Focus, a lack of access, market intel, and not being able to cut through cognitive biases (investors being too polite to say ‘no’), will lead to a significant amount of time being wasted on leads who aren’t interested or just filling a quota of managers they have to speak with on a weekly basis.

In terms of Sales Plan, a lack of regulatory understanding, poor comms and engagement, and not being able to measure one’s impact, opens up a Pandora’s box of problemos. At the very least you are risking no engagement with investors, and at the extreme you are risking a reputational hit with a regulatory sanction, that could wind up being fatal for the firm.

Finally, in terms of Execution, the lack of a robust & frictionless workflow, will lead to too many resources being allocated to admin tasks that technology can pick at pennies on the dollar.

So What Now?

When the landscape for assets is shifting in favour of cheaper, more liquid ‘smart’ products (ARP, ETFs, UCITS etc.) the industry will inevitably need to embrace the scale that technology offers in order to remain competitive.

As part of a subsequent series of posts I will aim to map out a technology utility belt that would make Batman envious (if he was a fund marketer). I’ll be diving into how fund marketers have been leveraging various technologies to growth hack their way to a happy place, and share some key learnings along the way.

Very Best,

Léopold