It’s long been said that the Hedge Fund industry is a conservative one, in which old habits die-hard. Stop me if you’ve heard this one before:

Fund Marketer: “Thank you for your time, very nice meeting you.”

Investor: “You too, put me on your distribution list and we’ll follow up”

The marketer will oblige the request and add yet another email address to a growing and unwieldy distribution list.

In this article, we will dive into:

- Why this seemingly harmless task could end up on the wrong side of GDPR costing your firm EUR 20m or 4% of global turnover, whichever is higher.

- Next, we will look at this practice through the lens of efficiency, whilst it might be the easiest task in the world to attach a pdf and hit ‘send all’, hence efficient from the marketer’s standpoint, it’s certainly one of the least efficient ways of engaging investors. Part 2 will essentially unveil the hidden costs of raising capital the old school way.

- Last, we will take these ‘hidden’ pain points and demonstrate how technology, in all its 21st Century wonder has moved on from the sludge of pdfs and emails towards a better, safer and more compliant way of working.

The Perils of Emailing Factsheets

(This is important if any of your prospective investors are based in the EU, or if the fund manager is based in the EU).

Show of hands: How many of you have given much thought to your monthly distribution email? My guess: not many. Here’s the rub…

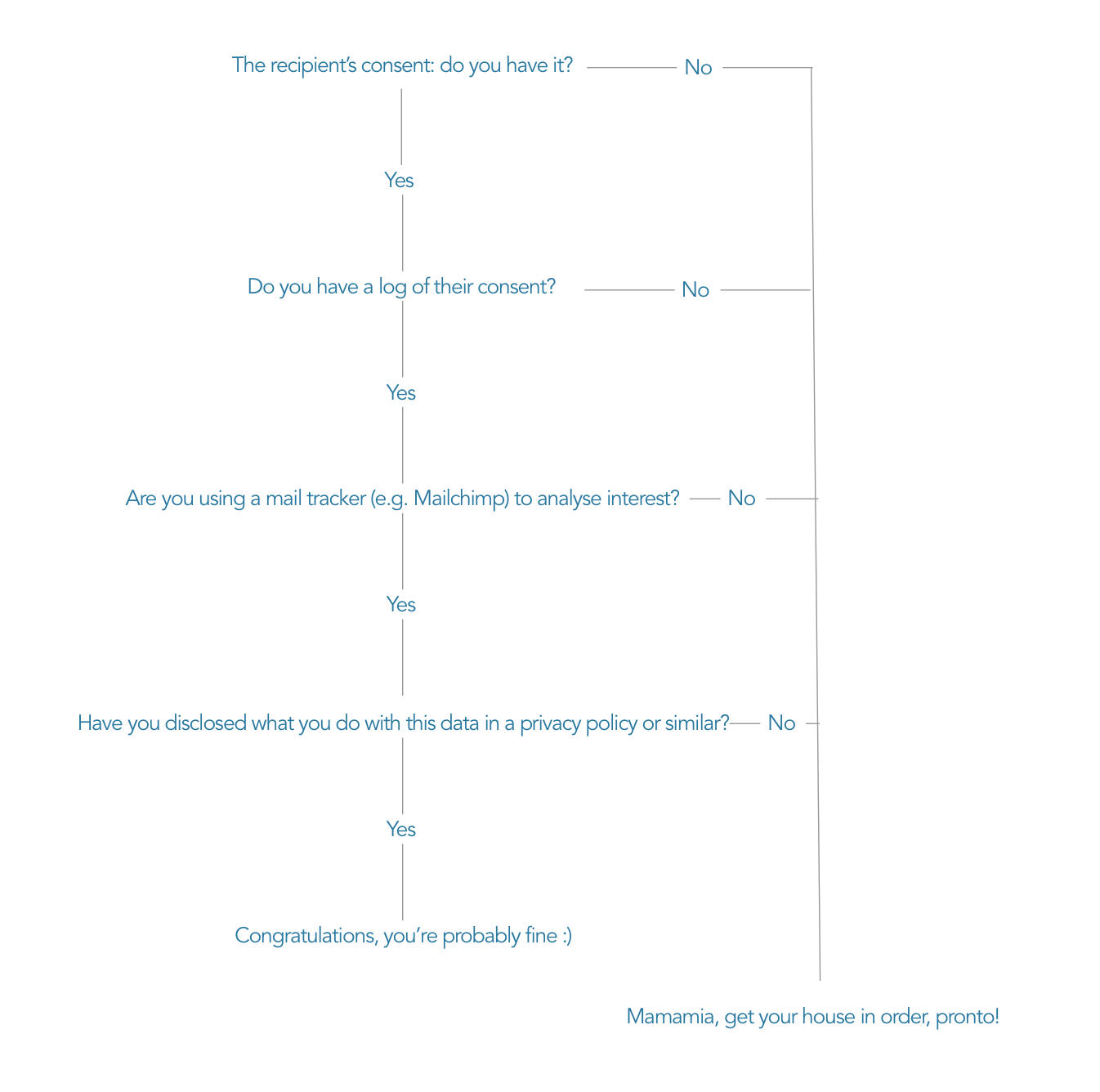

Since 25th of May, GDPR is in full swing. This means that when you next send out a distribution email to a list of recipients, you’re going to have to think a bit more broadly about what hitting that send button means. Here’s a decision tree to help you do just that:

If you’ve ended up on ‘Mamamia, get your house in order, pronto’, you are far from being alone:

In fact, in a recent survey of over 50 European Hedge Funds who are users of the Edgefolio platform, 80% fell into this category. 17% were ahead of the curve, with 3% choosing to stop sending distribution emails altogether post 25th May ( à la JD Wetherspoon).

So what’s the downside? You might want to sit down for this part…

Should any of your recipients report you to the Informations Commissioners Office (or equivalent) for a breach of privacy, and you are found to be on the wrong side of GDPR, you can face a fine of up to EUR 20m or 4% of global turnover, whichever is larger.

#Ouch.

Upon reflection, there are only a handful of Hedge Funds who could theoretically survive such a hit and come out unscathed, if you are one of them, my congratulations. However, if you are not the life-incarnation of Bobby Axelrod, then exercising a little caution could be a little more appetising. Here’s the math :

- Average AUM: $100m

- Average fee structure: 1.5 & 15%

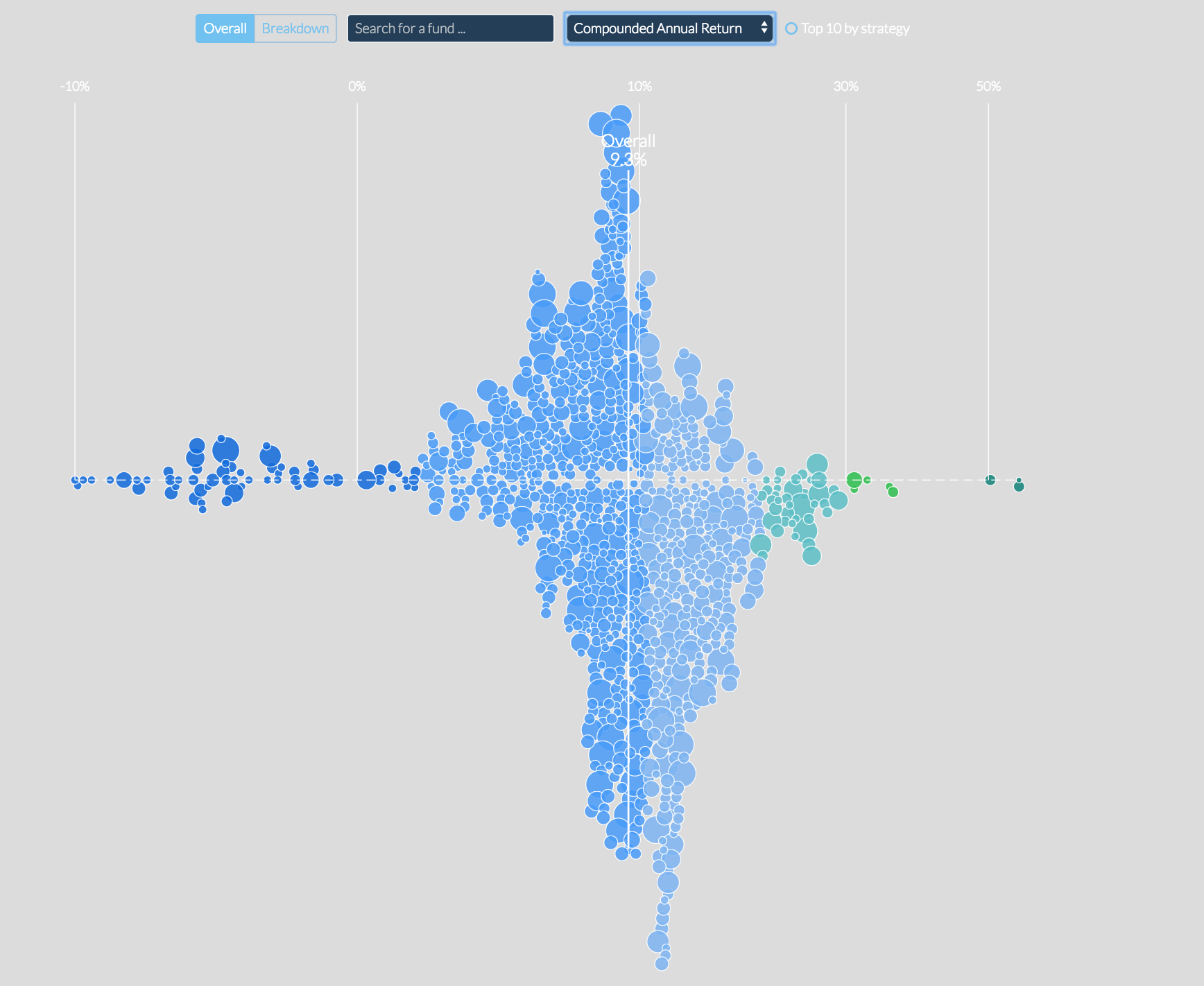

- Average annualised performance: 9.3% (Edgefolio HF index)

- $1.5M in Management Fees

- $1.4M in Performance Fees

- EUR 20M > 4% of $3.9m = “Merde”

Merde indeed. At this point I suspect Fund managers will be asking the question:

Yes, but how likely is this to happen?

Whilst the widely held view is that it is a deterrent, rather than an active force (the carrot, rather than the stick), hopefully this won’t be a material threat.

However, nothing is stopping other member states or indeed the Europeans from making your firm the example. And the EC has a penchant for publicly aired fisticuffs with everyone’s favourite scapegoat of the moment.

On the surface, non-compliance would appear to be a fool’s game. With the downside so large, why risk your fund & firm, for an emailing list?

Indeed, what is it about this approach to marketing that has survived the test of time?

It would be unfair of me to just point at the downside without highlighting the merits brought about by mass emailing your non interactive pdf to thousands of investors, whose inboxes are inundated with thousands of equally exciting emails.

The question I would like answered, is the following:

‘Does factsheet distribution by email even deliver any material benefit? Or is it just the crystallisation of habit?’

Requiem for an Impact

Scale.

It’s what organisations strive for in everything they do. It boils down to having a measurable impact resulting from a seemingly simple, yet amplifiable process.

Whilst the idea of sending emails to thousands of recipients has the air of a scalable operation, it is the aspect of measurable impact, or the lack thereof that ultimately determines whether any discernible value was created, for you, the firm and the investors.

We live in a data-driven world, which is also full of noise and hubris. Allocators, owing to the fact they manage other organisations capital, are more risk averse and focused on accessing data than ever before.

They are more demanding towards fund’s processes, all to achieve a greater sense of security and comfort that they know what is going on with their clients’ capital.

Bottom Line: Processes matter as much as performance for allocators.

So with that in mind, does a flat file pdf constitute meaningful data?

Short answer, no.

Is what you are sending valuable?

In Jan 2018 we interviewed over 30 institutional investors and allocators as part of our UX efforts, and inferred that the following are the most important points for the modern investor in 2018:

- The ability to access real timely data, whether it be performance or exposures

- The ability to port this data efficiently (downloadable, or API access)

- The ability to analyse, manipulate and test this data under various inputs

- The ability to access all documents and content from a manager in one place

The modern day investor requires data, interactivity, and self service. Factsheets are useful, but they are part of a broader bouquet of information that will ultimately assist the investor in accelerating their decision making. The classic Win-Win

Measurable Impact

Next, according to data compiled from Mail Chimp, Mandrill, and other similar services, the open rate for these distribution emails (within asset management) hover just above 3%. Whilst the click through rate weighs in at a measly 1%. So if you were to send an your factsheets to a sample size of 1000 investors, you will likely get 10 investors reading your factsheet. Meh, right?

The fact that of the top 100 hedge funds by AUM, 95% do not share investor related information via email, but rather via a secure portal speaks volumes. They have done their own assessment, and realised that the upside of blasting emails is somewhat limited.

Other considerations

A very real risk, and this has happened more than a few times, is the error prone fund marketer who sends the factsheet, with all recipients in Cc: Nightmare. Huge reputation risk for a tiny mistake.

A final consideration is the security aspect around the integrity of your data. Emailing an attachment opens up all sorts of undesirable outcomes, e.g. your material ending up fwd: fwd: fwd: to the press, to a competitor, and worse still to a retail investor.

Balancing Act

As a fund marketer you want investors to be informed about what you do, but not at the risk of a EUR 20m fine for 10 investors clicks? That’s EUR 2m per click!

Investors want actionable data, but they are getting thousands of pdfs in their inbox every month. The fund marketer wants to add an element of scale to the business, but the lack of engagement makes it near impossible.

This is a broken process, and it’s not going to impress investors. Something has to give.

There is good news, however.

Are there better ways of doing this in a GDPR world?

Yes, they’ve been around and part of the industry for a while. Portals. However, this really only solves the ‘all documents in one place’ slice of the pie. As a result they all tend to look the same, do the same thing, and don’t drive engagement. I mean how exciting can a slower more painful windows explorer in an i-frame be? (sorry Intralinks). So good-ish, but not quite there.

There exists one solution, Fundportal, which combines data, content and documents and top notch security to give the investors and allocators the fresh and convenient destination for all their needs. And it ticks all the boxes:

- GDPR compliance with opt-ins built into the on-boarding process

- MiFID II compliance with logging of investor communications

- Jurisdictional self certification

- Self-service document room

- Interactive data and analysis tools

- Engagement rates of around 10% of entire audience. 10x increase on the incumbent

- Secure and encrypted

- Dynamic watermarking and time-stamping of content

- Robust permissioning system to unlock access to content that is relevant to the investors’ stage in the sales cycle.

- It looks amazing on iPad, and is blazing fast

You want to see how this works? Schedule a demo with us!

Léopold Gasteen, Founder of Edgefolio