What drives growth in a competitive landscape

Hedge funds which have traditionally depended on personal relationships to acquire capital have recently found their business model turned on its head in the wake of an unrelenting tide of digital disruption.

Rising competition from alternative opportunities and increasing scepticism about the effectiveness of actively managed funds have piled pressure on operators to reduce their management fees and tighten their belts. Managers are now looking to new approaches to target investors at scale, through digital marketing and data-driven techniques.

In this excerpt, we highlight some of the driving growth behaviours for hedge funds from our recent study of operators and investors, in partnership with GPP and the AIMA.

Marketing spend for growing hedge funds

As far as marketing sophistication goes, hedge funds have developed a reputation for lagging far behind other financial and professional services. While many have applied standard marketing tools and tactics, such as having a website and a social media presence, some fund managers continue to embrace the idea that an opaque brand image creates a sense of mystique and exclusivity that appeals to their clients. In our survey, we looked at some of the most important considerations for growing hedge funds.

A key one being marketing, how much should a growing hedge fund be allocating to its marketing spend and at what stage in its initial growth should marketing be a priority. Our respondents told us that passing the $100m AUM barrier is seen as a major milestone in a fund’s long-term success and opens it up to cap-intro opportunities from institutional investors.

Building a fund to this stage, with desirably low marketing costs, requires a degree of balance by demonstrating credibility with a robust track record before exposing the fund to a wider pool of potential investors. However, it should not be surprising that 94% of managers with less than $100m AUM are actively marketing their fund to prospective investors.

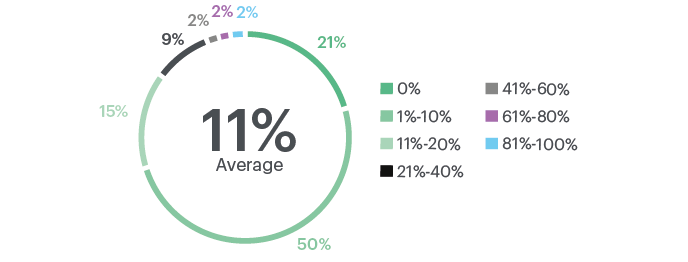

Percentage of management fees spent on marketing

Of the managers surveyed, those running less than $100 AUM were spending, on average, 19% of their management fees revenue on marketing – up from an average of 11% for those managing over $100m AUM.

Hiring marketing talent

For emerging funds, investing in marketing can be seen as unnecessary until the fund is larger. Although this chicken and egg scenario can be problematic for managers, it was clear that investing in marketing is critical and was reiterated in roundtable sessions with firm advice to concentrate on marketing or hire a marketer early in the fund’s lifecycle.

Not one manager with greater than a billion dollars AUM nor any manager running between $100m and $500m AUM outsourced their marketing function. The managers that we spoke to were very clear in their belief that investment is required in the marketing function right from the start of the fund’s life and is integral to the development of managers of all sizes.

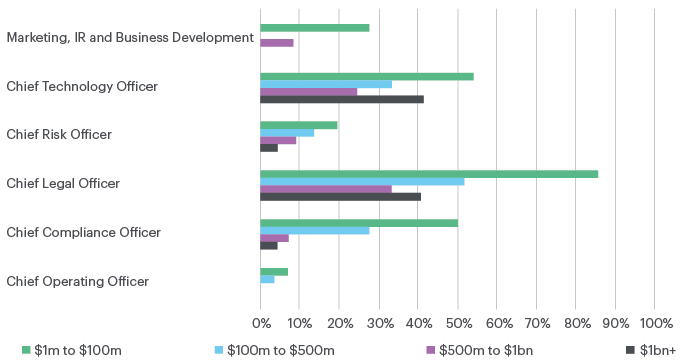

Managers with an internal resource or outsource the following function

There are rules as to what other roles that managers should outsource and at what size of AUM. The Chief Operating Officer (COO) function is the least outsourced, however some functions are consistently outsourced – notably, the Chief Technology Officer (CTO) role is almost universal across funds of all AUM size.

In the cases where sub $100m fund managers did not invest in marketing, it was often the case that marketing responsibilities were taken on by the role of the CEO, CIO or COO – effectively diluting time dedicated to their primary role in the interim of having a dedicated marketing function.

Investors in our survey were also shown to receive marketing content positively and confirmed the importance of maintaining access to the manager during and after the investment process. By offering allocators transparency around the hedge fund strategy, approach to risk and correlation to the market, smaller funds could mitigate the effects of a short track record.

Time spent on raising capital

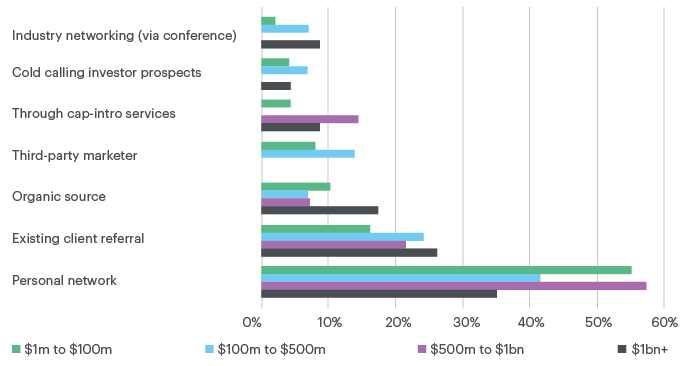

Fund managers, regardless of AUM, were likely to have used their personal network to source a recent investment. We also found that emerging managers were less likely to have spent time on the more potentially time-consuming methods.

Managers source of most recent investment

This is especially true when trying to source capital introduction services (cap-Intro). Only 4% of emerging managers sourced their last investment from cap-Intro versus 25% of $500m+ managers.

Investors desire for data

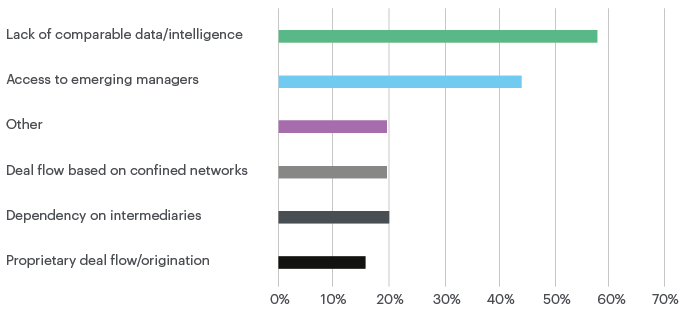

Today’s investors are much more data-driven and have come to demand a greater level of transparency and more frequent communication from their fund managers. With a wider range of fund information at their disposal, it is no surprise to see that a lack of comparable data and the manual nature of the due diligence process is a major challenge to the allocation process for those hedge funds that manage below $1bn.

Investor challenges identifying hedge fund opportunities under $1bn AUM

Conclusion

Increased pressure on fund managers has made it ever more important for their time to be spent effectively and on value-generating tasks for their firm. Marketing has been found to be both a key growth opportunity and a critical investment to make in an emerging fund to ensure its future success. However, the time spent on this activity, particularly by non-marketing personnel in the firm, needs to be carefully vested to ensure that other functions are tended to and that investors are in regular communication with the management team.

A solution to these time pressures may be found in asset management technology. As seen throughout multiple industries, technology has provided a means of increasing efficiency by automating repetitive tasks, enabling more regular communication and providing self-serve access to information.

Managers looking to implement technology solutions for their marketing and communications operations should look to approaches from their peers and other industries, ensuring that any platform adopted delivers time efficiencies and value for both their firm and their clients.

FundPortal from Edgefolio offers marketing tools, file sharing and analytics solutions for fund marketers and managers alike. If you would like to find out more or to see a demo, feel free to contact us.