ESTea #6 07/06/21

The race for talent in ESG

With ESG a growing theme at almost every financial institution, investor, and fund – there is a growing battle for the best ESG talent with no obvious answer of how that demand is going to be filled.

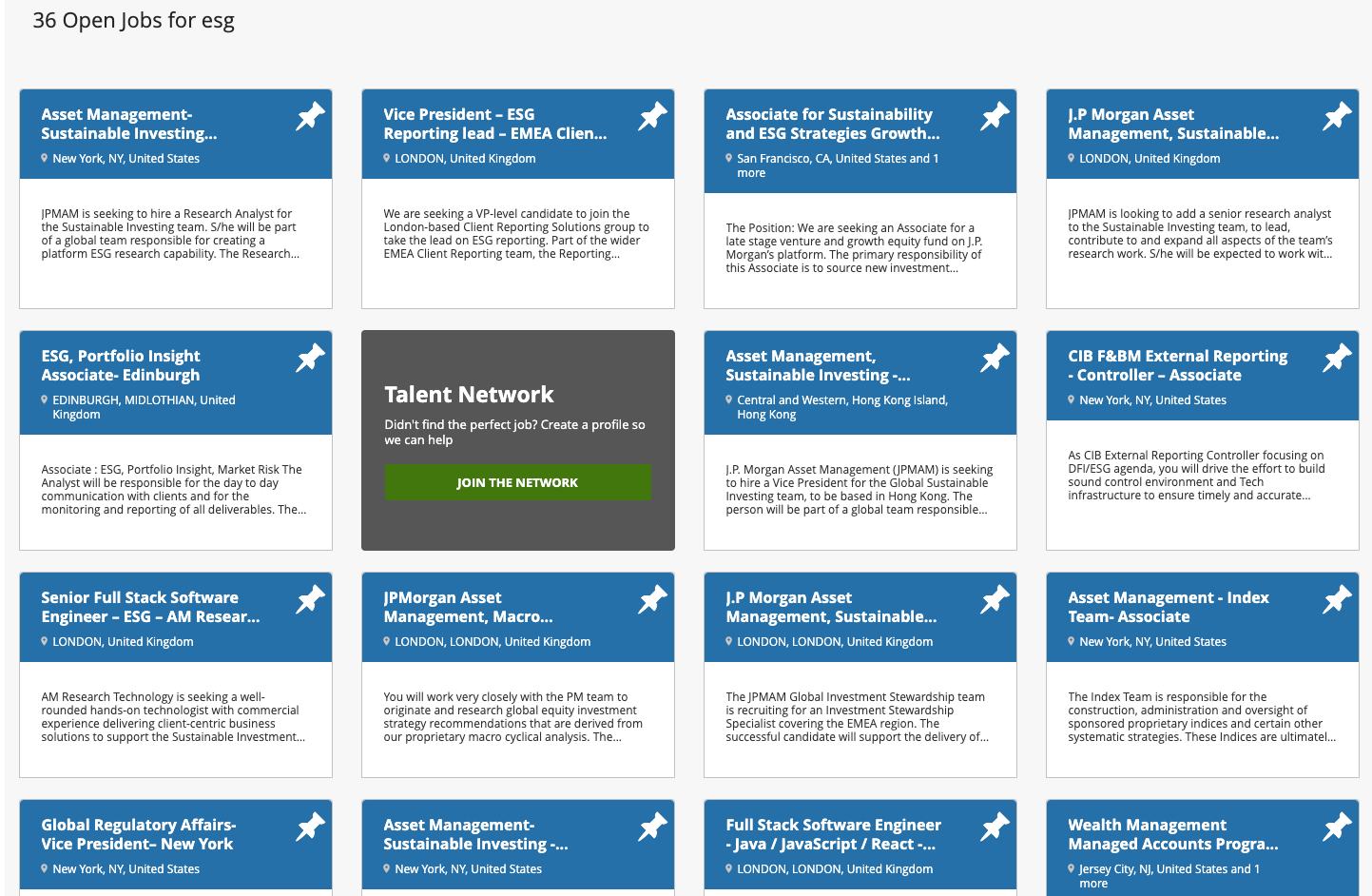

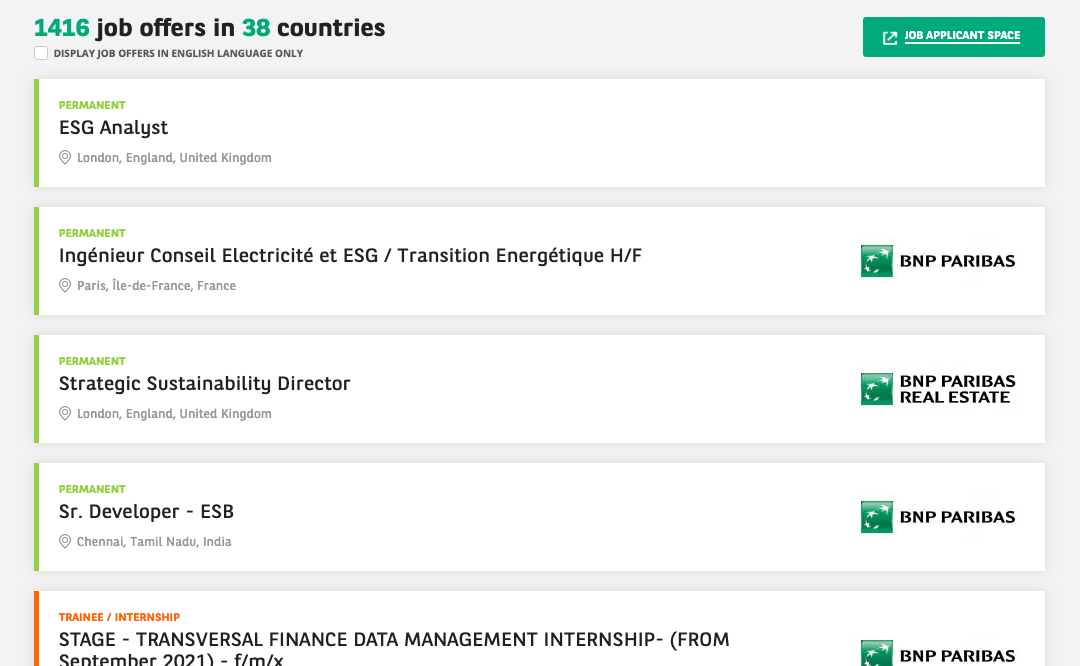

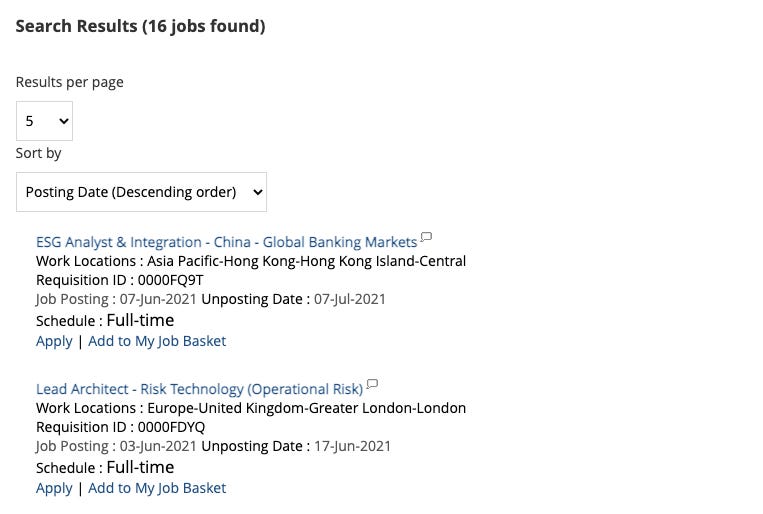

Looking through the ‘careers’ listings of the top financial institutions in the world, you can find ESG roles throughout the business. This includes analysis, programming, clients relations and more. Interestingly, there is a mix of both dedicated ESG roles and traditional banking roles that now require ESG credentials as part of the selection criteria.

With only around 100 full time climate change or carbon accounting masters programs running in the UK each year, and only a fraction of those graduates having an interest in the financial sector – this talent crunch won’t resolve soon.

Options

There aren’t many options open to the financial institutions who have recently committed to all types of ESG goals and are now in dire need of the expertise. They only have two ways to go:

- Fight hard with salary and benefits. This is unlikely to resolve the problem since many of candidates won’t ever have considered a career in finance.

- Train internally. Organisations like BPP are beginning to offer suitable qualifications and putting forward existing employees may be the way to get ahead of competitors. But it won’t solve the short term problem.

Right now, it looks like 2 is the way to go. I wonder if we will see an explosion in carbon accounting courses over the coming year as SFDR begins to bite hard in Europe.

S and G?

Everything above speaks to the environmental aspects of this problem. This is because carbon accounting is both the most pressing issue and the easiest to solve. It’s easy to solve because academic institutions have decades of experience and expertise in thinking about how to account for carbon dioxide emissions and other forms of pollution. It’s simply a question of scale now.

It’s likely that the governance element of the question will be resolved by employing and retraining existing young lawyers but the social element poses a real issue.

Without clear agreement in the industry on what a good approach to the social element of investing is, it’s impossible for university and private companies to respond with training programs.

News

- SoftBank’s Son turns to female gaming pioneer to shake up board

- Carbon Measurement Platform Persefoni Adds Curtis Ravenel to Advisory Board

Link to original