Sales professionals are the face of the organization, the conduit of information, and the buffer zone to the PMs’ headspace. They have the ability to make or break the fund. So it’s important that salespeople are set up for success from the get-go.

In today’s piece we’re going to show you how to make a capital raising machine, and for the real connaisseurs, we will explore the potential pitfalls of the approach, and how you can leverage technology to do some of the heavy liftings and add some spice into the mix in our next piece.

Ingredients

Bar a great product (largely out of their control), a fund sales professional requires the following to be measurably successful:

- Goals: Where you want to take the fund over the next 12 weeks

- Focus: Know your market, and who you are going after. This is crucial

- Sales Plan: The actions you need to take to stay true to your goals with a high degree of certainty

- Execution: Following through with meticulous precision

- Cadence: The discipline to stick to your process and achieve mini steps with regular frequency

- Accountability: Learning from the mistakes, and owning the upside

Recipe:

Goals

Where do you want to take the fund over the next 12 weeks. Why 12 weeks? I hear you ask:

Thinking about what you can achieve in terms of years (annualised thinking) is the death of cadence and predictability, it also makes it really hard to keep one’s self honest around accountability and ownership. A 12 week horizon paves the way for bitesize goals and steady progress.

There is a superb book/audiobook on this subject, The 12 Week Year, you can find it on Amazon here.

For the sake of this piece, let’s assume our goal is to raise assets by $10m over the next 12 weeks.

Focus

Focus only on the relationships you currently have on tap, and the relationships you need to develop in order to hit your 12 week goals. This is actually hard to do, so focus on this alone. Nothing else matters

e.g. $10 = 2 x $5m tickets. Ticket size matches family offices, organise your contacts, time frame indicates that prospects should already be engaged. Identify a shortlist of top 10 investors for the next 12 week sprint.

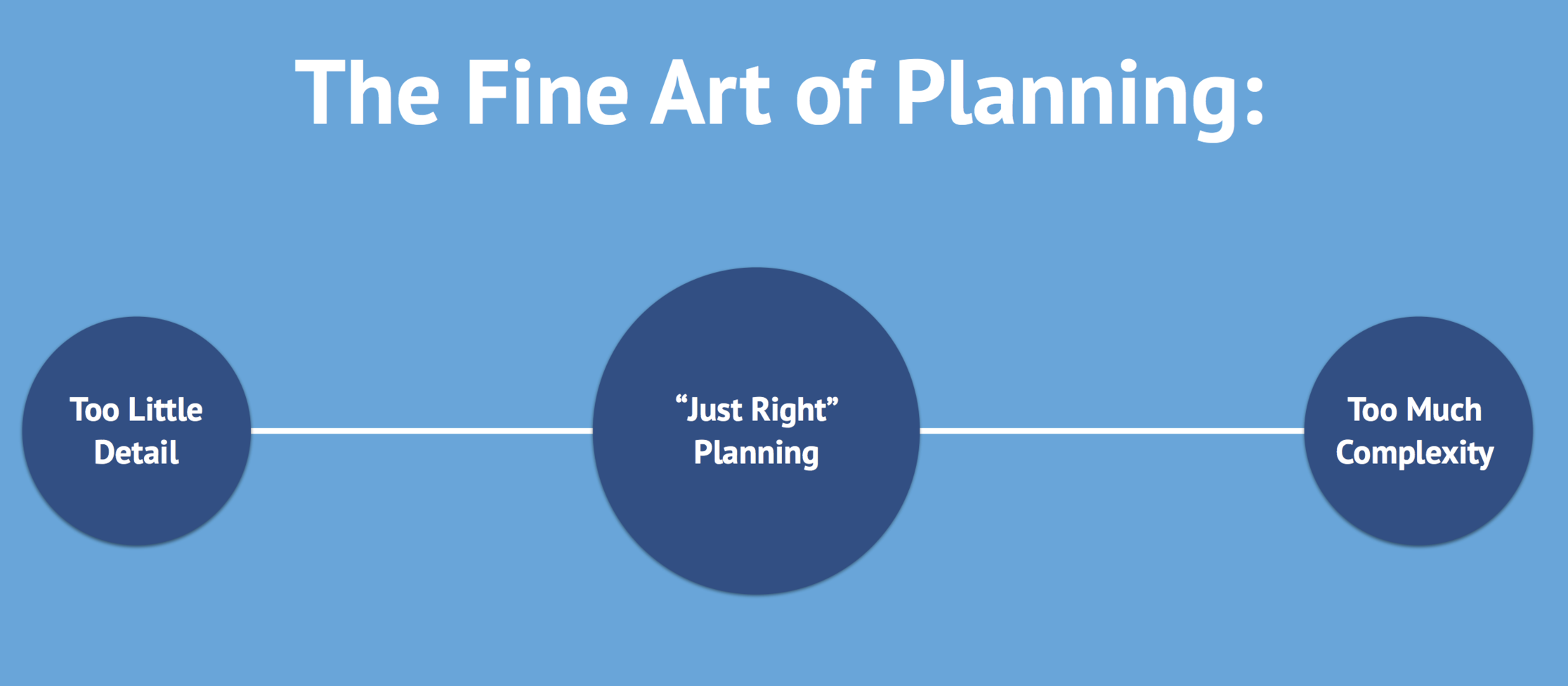

Plan

This is the easiest part. Just try to make it realistic and detailed enough.

Here’s a handy stencil for the plan:

- Build a hit-list of investors that tick these boxes: Type, Territorial, Size, and Ideological fit

- Figure out how you are going to approach, communicate with, engage and qualify prospects effectively (not distribution emails, read my last article on that). And spare a few thoughts on certain practices that are downright risky

- Set some weekly KPIs that fall out of the above to keep yourself honest e.g: #meetings, #calls, #conferences /week

- Measure your results daily, and honestly

Execute

Follow your plan (like a ninja, preferably).

Cadence

Story Time.

The epic showdown of Amundsen and Scott as they went head-to-head to conquer the South Pole sheds a tonne of light on the power of cadence.

Scott, the hard headed Brit, took horses and marched his men as far a they could go on fair weather days, and rested on bad weather days.

Amundsen, the determined Norwegian, took dogs, and marched his men 20 miles a day come rain, blizzard, storm or shine.

Owing to a combination of unpredictable weather, poor choice in four legged companions, and his fair-weather approach, Scott and his men burned through their supplies much faster, progressed slower, and eventually burnt out – succumbing to the elements.

Amundsen, by contrast, ploughed through the harshest and most unpredictable of environments and hit his goal of 20 miles every day, was the first human to reach the South Pole, and even lived to tell the tale.

For the fund sales professional: her environment is harsh (investors) and unpredictable (markets), and she might just find comfort in Amundsen’s approach.

Accountability

Accountability is not consequences, but ownership. It is a character trait, a life stance, a willingness to own your actions and results regardless of the circumstances

You can choose not to follow through, not to have cadence, and not to have laser like focus. Accountability is not something that is imposed on you, but something you adorn.

If you own your goals, you are far more likely to chip away at them and make an impact.

Own your goals.

Deus ex Machina

By working with leading Hedge Fund Marketers, and Sales Professionals across the industry, we have found that the most consistent pattern for success has been the combination of these key ingredients.

By setting a clear goal, with ruthless focus and impeccable execution your fundraising machine will outperform most of the industry. Adding the essential benefits of cadence and accountability will lock in a process that will have your firm feasting for years to come!

In the next piece, we will explore the hidden costs of fundraising, and how with a little introspection we can fine tune your fundraising machine into a rocket.