Asset management marketing in a digital world

Hedge funds which have traditionally depended on personal relationships to acquire capital have recently found their business model turned on its head in the wake of an unrelenting tide of digital disruption.

Advancing in the digital age – How technology pioneers will make the difference

Legacy systems and legacy thinking can also be formidable barriers. The status quo is hard to challenge when profit margins are reportedly around 40 percent.

Essential content marketing strategies for asset managers

Asset managers are looking to content marketing strategies to build relationships with investors. Many are increasing their marketing budget, but what does content marketing look like for asset managers in the hedge fund industry?

LinkedIn for asset fundraising

LinkedIn presents an opportunity for asset managers to grow their presence and build relationships with investors in a highly targeted digital channel. In this article, we cover the most effective strategies to obtain business results.

Why you need a hedge fund CRM

A CRM designed for hedge fund managers can elimate customisation costs, provide features tailored for hedge funds and reduce administration costs.

Digitalisation of hedge fund marketing

As far as marketing sophistication goes, the hedge fund industry has built a reputation for lagging far behind many other financial and professional services.

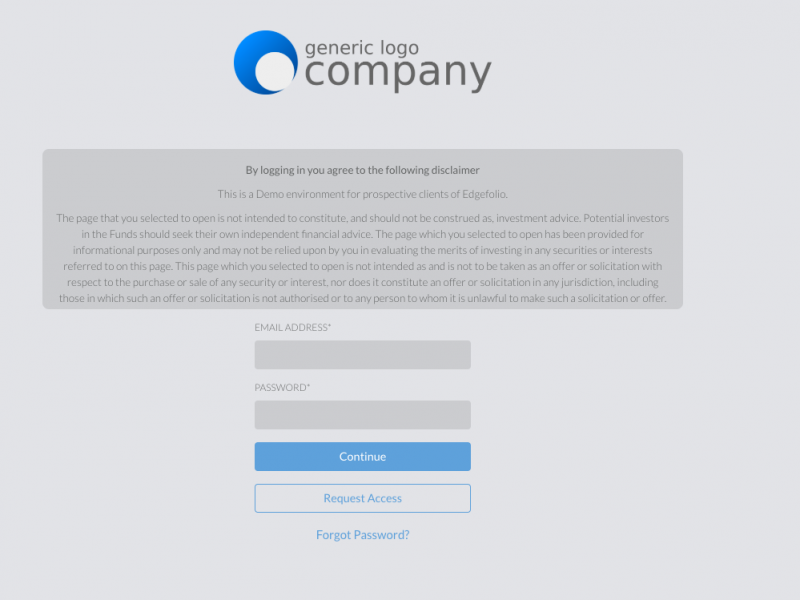

Hedge fund marketing starter pack: Getting leads straight through your website

When it comes to Hedge funds, all the regulations, the compliance headaches and the costs associated with spreading the word are prohibiting the Marketing Manager to publicly declare that the fund is doing great.

How to differentiate your fund in a conference

Think of the following scenario:

You start planning your trip long in advance before the actual event. You arrange the flights, the hotel, the material you need and you try to plan ahead your sales strategy.

The Road to $1bn AUM: “Making it Big” Survey

The research examines big managers’ path to growth, providing a roadmap for all emerging and start-up managers as they make their way to $1bn AUM.