Managed security and branded document portals are growing in popularity as hedge funds become cautious of cybersecurity threats to their business.

In today’s world, sharing financial documents by email or with consumer cloud storage tools is not an efficient or scalable solution for growing hedge funds – especially for those seeking institutional backing who often require more robust security measures to comply with MiFID II.

However, with a document portal, investors can benefit from secure online access to access funds, portfolios and account focused information. Fund managers are also able to have greater control over their fund information content and how they manage relationships with investors.

What is a Document Portal?

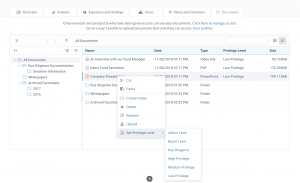

Also known as a data room, a document portal is an online library of key fund documents (NDAs, DDQ files, balance statements, etc.) that can be provided in an easily accessible and secure environment. It keeps funds legislatively compliant while offering levels of control over who can access specific documents while providing visibility into who has accessed them.

A major benefit of a document portal is the ability to automatically update and share up to date documentation with investors. In doing so, fund managers can spend less time manually sharing monthly updates on fund performance, onboard clients more efficiently and enable timely investment decisions by providing the ability to self-search fund information.

Scalable Document Storage & Access Permissions

Popular cloud storage tools are great for sharing files with small groups at a low cost, but as the business scales up, they quickly become inefficient and notably lack the ability to integrate with industry leading CRM systems in a commercial application.

Once a firm expands and requires additional applications to distribute investor documents, a branded document portal will offer much-needed control and provide the ability to set access permissions for select users.

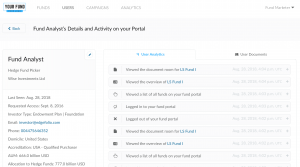

Additionally, fund managers are able to analyze the content their clients are interested in and take a more targeted approach when communicating with them. Further details about how this feature works can be read in our earlier blog post on sharing user-specific investor documents.

MiFID II Compliance

Fund managers are required to comply with the MiFID II regulation. The SEC currently advises that funds retain all internal and external email and instant messenger business communications, a perspective that is often commonly shared amongst investors as well.

Failure to deal with potential compliance issues exposes fund managers to the risk of lawsuits and can deter new investors. For attorneys and advisors representing hedge funds or investors, carrying due diligence on compliance with MiFID II is warranted and prudent for all parties involved.

By using a document portal, fund managers are able to mitigate these risks and maintain an audit trail of who’s opened and read which document.

Investor Confidence

Institutional investors are less likely to be comfortable with sharing their information via a public file sharing service which lacks the adequate security precautions for transferring sensitive data.

Having a secure platform for sharing financial documents protects your fund’s data and safeguards its reputation. It also instills confidence with all stakeholders as a disaster recovery solution is seamlessly integrated to ensure that fund information is protected in the event of a data breach.

You can head over here to read more about FundPortal, the document portal solution from EdgeFolio. If you would like to find out more or request a tour of the tool, feel free to contact us.

Sign up to our newsletter for further updates from the EdgeFolio blog.